Cryptocurrency Market Surges: Navigating the Booming Crypto Space with Caution

The Cryptocurrency Bull Market: A Closer Look at Bitcoin's Milestone

The cryptocurrency market is witnessing an unprecedented bull run, with Bitcoin leading the charge by hitting a $1 trillion market cap. This remarkable milestone has not only caught the attention of previous crypto investors but also ignited discussions on the sustainability of this growth amidst the absence of crypto commercials during significant events like the Super Bowl. The excitement around Bitcoin and its all-time highs has prompted a cautious optimism, drawing parallels with scenes from the movie Animal House, emphasizing the need for restraint and strategic silence to prolong the bull market's benefits.

Bitcoin's Value Soars Beyond Expectations

Bitcoin's ascent to over a trillion dollars in market cap is a testament to the growing demand and interest from both retail and institutional investors. The introduction of Bitcoin ETFs has played a significant role in this surge, capturing more Bitcoin than miners can produce and signifying a shift in the narrative towards real inflows. This development, coupled with Fidelity's inclusion of crypto in their ETFs and Wall Street's burgeoning love affair with Bitcoin, underscores the evolving landscape of investment despite regulatory skepticism from figures like the SEC's Gary Gensler.

Ethereum and the Crypto Market's Explosive Growth

As Bitcoin and Ethereum showcase significant growth, the total crypto market cap has breezed past $2 trillion, marking considerable gains across various sectors including crypto gaming and DeFi. Ethereum's potential for growth and the anticipation around Ethereum ETFs highlight the diverse market structure and the transformative impact of Layer 2 solutions. The Ether ETF's potential to reduce regulatory risk further bolsters the optimism for substantial price action in the near future.

Innovations and Regulatory Challenges in the Crypto Industry

The crypto industry's expansion is underscored by trusted exchanges like Kraken, groundbreaking scaling solutions like Arbitrum, and tools like crypto tax calculators that simplify tax season for investors. However, the horizon is dotted with challenges, including the anticipated $2 trillion airdrop and regulatory hurdles that necessitate caution against scams and emphasize the importance of eligibility for participation in the booming market.

Navigating Scams and Regulatory Constraints

The excitement around the Stark net airdrop and the growing interest in crypto savings accounts bring to light the critical need for vigilance against scams and the importance of meeting eligibility criteria. The mixed reactions to token distribution criteria and the consequent community sentiment underscore the complexities of distributing benefits in a fair and inclusive manner, highlighting the ongoing arms race between token distributors and farmers.

The Future of Crypto: Opportunities and Ethical Considerations

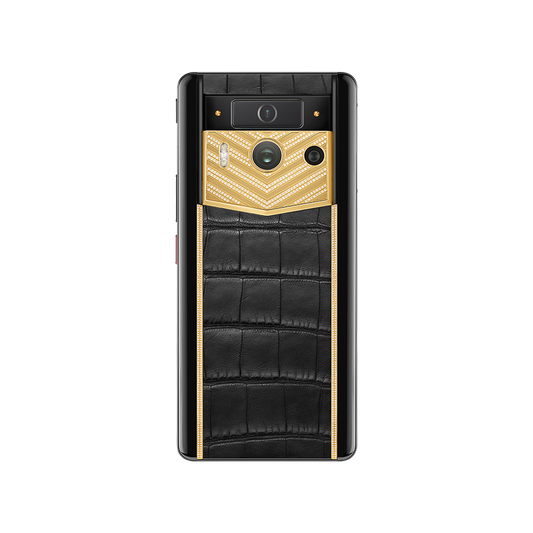

The introduction of the Starkware token and discussions around entitlement in the crypto space reflect the broader conversations about fairness, innovation, and the ethical considerations of airdrops. Projects like Cell, a mobile-first blockchain, aim to address these challenges by offering low gas fees and community governance, reinforcing the crypto ecosystem's capacity for self-regulation and sustainable growth.

Crypto for Fundraising and the Geofencing Dilemma

The increasing reliance on cryptocurrency for fundraising and donations, amidst the geofencing of American users by DeFi platforms, highlights the regulatory constraints impacting the industry. The case for using crypto to support causes and individuals facing banking restrictions showcases the technology's potential to offer alternative financial solutions, even as regulatory pressures loom large.

Looking Ahead: Investing in Cryptocurrency and the Impact of Regulation

The evolving landscape of cryptocurrency investment, marked by government scrutiny and the potential for market manipulation, poses significant questions for the future of digital assets. The efforts to innovate in the chip industry and the strategic moves by companies like Coinbase to navigate regulatory challenges underscore the dynamic and uncertain path forward for cryptocurrency, emphasizing the need for informed and cautious participation in this booming market.

No comments