Exploring Altcoin Investment Strategies in 2024

Introduction to Diverse Crypto Investment in 2024

The year 2024 marks a significant era in the realm of cryptocurrencies, with an increasing focus on diversification beyond the dominion of Bitcoin. As we delve into this transformative phase, it's essential to understand the potential of altcoins in shaping investment strategies. This article aims to explore a range of altcoin investments, including Ethereum, Solana, Cardano, Avalanche, Polka Dot, and others, each offering unique opportunities for growth and accumulation of Bitcoin in the forthcoming bull market.

Investing in Bitcoin and Ethereum: The Cornerstone of Crypto Growth

With a historical precedence of being the best performing assets over the last decade, cryptocurrencies like Bitcoin and Ethereum present an unmissable opportunity for investors in 2024. The strategy involves an initial investment of $1000, primarily allocated to Bitcoin and Ethereum. This approach not only aims at capitalizing on the bull market but also endeavors to accumulate more Bitcoin, thereby embracing a risk-inclined investment posture.

Black Rock's ETF Strategy and Ethereum's Prominence

Black Rock's movement towards accumulating assets for sale through ETFs signals a pivotal shift in investment trends. Particularly, Ethereum stands out as a formidable investment in 2024. Its continuous evolution and adoption in various blockchain applications make it a strong contender for substantial growth in the upcoming bull market.

The Rise of Ethereum ETF and Altcoins with Novel Tokenomics

The inception of Ethereum ETFs offers investors a streamlined avenue to participate in Ethereum's growth. Additionally, investing in altcoins with innovative tokenomics can potentially lead to significant value appreciation. These investments are not just about growth but also about understanding and leveraging the unique economic models that these new token systems present.

Diversifying with a Basket of Altcoins

A strategic basket of 3-4 altcoins, encompassing both layer 1 (L1) and layer 2 (L2) solutions, can serve as a robust approach to accumulate more Bitcoin. This diversification taps into the potential gains offered by these alternate cryptocurrencies, thereby expanding the growth horizon beyond the traditional crypto assets.

Selecting High Potential Altcoins for 2024

The selection of altcoins like Solana, Cardano, Avalanche, and Polka Dot is grounded in their demonstrated performance and growth potential. Further diversification with Cardano, Polka Dot, Cosmos, Injective, Chainlink, Uniswap, and The Graph offers a balanced portfolio, catering to different market segments including high caps, midcaps, decentralized finance (DeFi), and gaming.

Exploring Emerging Crypto Assets

The crypto landscape is continually evolving with emerging assets like Gala, Apoin, Alium, Hello, Star Atlas, AI coins, and data storage solutions. These diverse investments not only promise growth but also offer exposure to the latest developments in the crypto space, including AI and data infrastructure.

AI Data Infrastructure and Discerning Investment Choices

The AI data infrastructure, particularly the AIT protocol, represents a forward-looking investment, contrasting starkly with options like Dogecoin, which may be less favorable due to concerns over team dynamics, project use case, tokenomics, and technology.

Investing in Low Cap Coins with Strong Communities

Low cap coins with robust communities offer unique investment opportunities. The focus here is not just on the ecosystem's potential but also on the community's belief and input in the project, which can be a significant factor in the success of these investments.

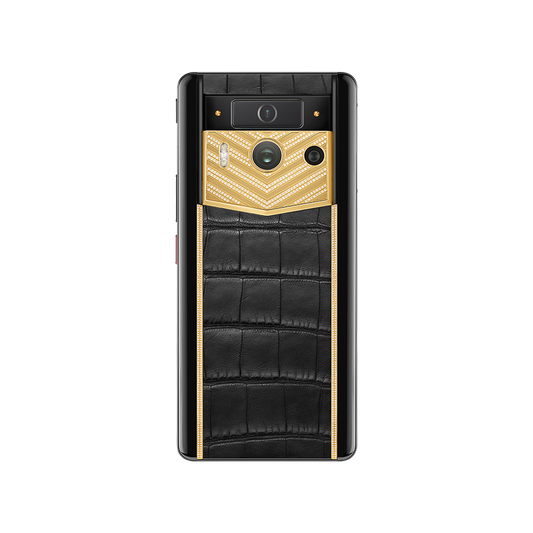

Incorporating MPC Wallet in Your Crypto Strategy

An essential aspect of these investment strategies is the use of secure and efficient wallets, like the MPC wallet. MPC (Multi-Party Computation) wallets provide enhanced security features, making them a vital tool for investors who are diversifying their portfolio across various cryptocurrencies. The use of such advanced wallets ensures safe storage and management of digital assets, aligning with the dynamic nature of the 2024 crypto market.

Conclusion

The investment landscape in 2024 offers a plethora of opportunities in the cryptocurrency domain. From Ethereum ETFs to a diverse array of altcoins, each investment avenue presents unique potentials and challenges. Incorporating these strategies into your investment portfolio requires a nuanced understanding of the market dynamics and an appreciation for the technological advancements in crypto storage solutions like MPC wallets. As the market evolves, so does the approach to crypto investment, making adaptability and informed decision-making key to capitalizing on the 2024 bull market.

(video from: https://youtu.be/U8tKyXRd_JE)

No comments