Investing in Luxury Watches vs. Gold Bars: A Detailed Analysis

Introduction

Investing in luxury items like watches and gold bars has gained popularity over the years, offering not just a symbol of status and wealth but also a potential for high returns. This article explores the investment prospects of luxury watches in comparison with gold bars, focusing on factors like market volatility, value appreciation, and economic stability.

Understanding the Market Dynamics

While both luxury watches and gold bars are esteemed for their potential to yield substantial returns, they operate within different market dynamics. Gold is known for its price volatility, similar to stocks, with values fluctuating based on economic indicators and market sentiment. Conversely, luxury watches, particularly those from high-end brands like Rolex, have shown resilience to market swings, often selling for millions at auctions due to their rarity and desirability.

The Investment Value of Luxury Watches

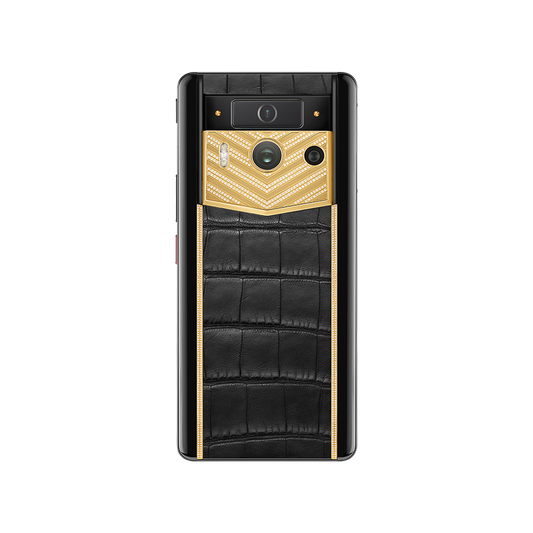

Luxury watches are not just time-telling devices but assets that can appreciate over time. The rarity, craftsmanship, and brand heritage of high-end watches contribute to their increasing value. Limited edition models, in particular, can see an appreciation of about 69% every 10 years, making them a lucrative investment for those seeking portfolio diversification and a touch of elegance.

Gold as a Tangible Asset

Gold has been revered throughout history for its scarcity and intrinsic value, often seen as a safe haven during times of economic uncertainty. Unlike stocks or real estate, gold offers a tangible asset that retains value, providing a reliable store of value and a hedge against inflation.

Comparing Performance and Style

Luxury watches offer an unparalleled blend of style, status, and investment potential. Their performance in the market is minimally correlated with the stock market, allowing for better returns during periods of volatility. On the other hand, gold provides a sense of security and stability, appealing to investors prioritizing long-term value preservation over style.

The Case for Diversification

Investing in luxury watches can be a smart strategy for diversifying an investment portfolio. With their unique combination of material craftsmanship and historical significance, rare and limited edition luxury watches present a niche but potentially profitable investment avenue. This diversification can help mitigate risks associated with more traditional investment forms like stocks or bonds.

Conclusion

The decision between investing in luxury watches and gold bars ultimately depends on the individual investor's goals, risk tolerance, and preference for style versus stability. Luxury watches offer a unique investment opportunity that combines aesthetic appeal with the potential for significant value appreciation, while gold remains a steadfast option for those seeking security and a hedge against economic uncertainty. By carefully considering these factors, investors can make informed decisions that align with their financial objectives and personal preferences.

(This content was created with the participation of AI, Video from: https://youtu.be/_0tCdWVeWeU)

No comments