Understanding the Current Luxury Watch Market: An Opportune Time to Buy

An Overview of the Luxury Watch Market Dynamics

The luxury watch market is undergoing a fascinating phase, characterized by fluctuating prices that present both challenges and opportunities for collectors and enthusiasts. Notably, prominent brands like Rolex, Patek Philippe, and Audemars Piguet (AP) are at the center of this volatility. This article delves into the current state of the watch market, highlighting why now might be the perfect time to invest in these sought-after timepieces.

Digital Transformation and Self-Improvement: A Personal Journey

In the realm of personal development and digital transformation, the pursuit of excellence is a continuous journey. For collectors and enthusiasts in the luxury watch market, this pursuit extends beyond personal growth to include the strategic acquisition of timepieces. Embracing digital tools and platforms can enhance one's ability to navigate the complex watch market, ultimately informing smarter purchasing decisions.

The Impact of Market Fluctuations on Luxury Watch Prices

Current market conditions have led to a noticeable decrease in the prices of luxury watches. This trend is particularly evident with high-demand models from Rolex, Patek Philippe, and Audemars Piguet. Factors contributing to this downturn include economic uncertainties and shifts in consumer spending habits. However, for savvy buyers, this represents an unprecedented opportunity to acquire prestigious models at more accessible price points.

The Appeal of Precious Metal Watches

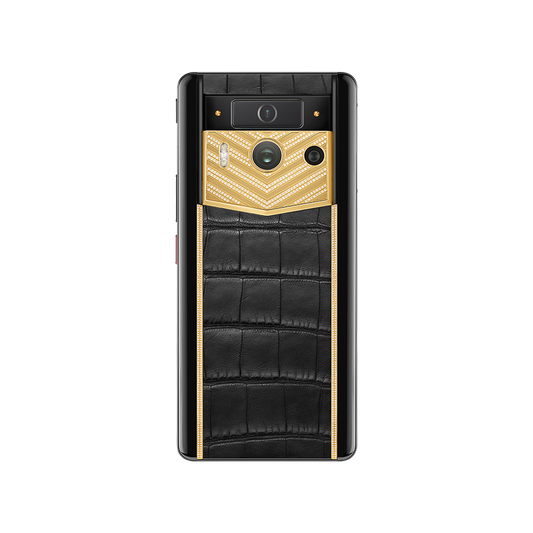

Special precious metal watches, such as the yellow gold Rolex Daytona with the Metate dial, have seen significant price reductions. This drop makes it an opportune moment to purchase these exquisite pieces. The rarity and inherent value of precious metal watches make them not only a statement of luxury but also a potential investment for the future.

Dissecting the Price Disparities in the Watch Market

The luxury watch market is currently experiencing shocking price disparities. Some models are fetching high prices on the secondary market, while others are available for less than their retail value. This volatility raises questions about the valuation of specific models, such as the Rolex green Dow Sky-Dweller, which commands a premium over its blue counterpart. Understanding these dynamics is crucial for making informed purchasing decisions.

The Case for Classic Watches

Despite the fluctuations, the market for classic luxury watches remains robust. Collectors and enthusiasts are advised to look beyond temporary price inflations and assess the intrinsic worth of a watch from a buyer's perspective. Classic timepieces, known for their timeless design and mechanical precision, represent a wise acquisition, especially in a market ripe for buying.

Exploring the Aftermarket: A Strategy for Buyers

Given the favorable conditions in the current watch market, exploring the aftermarket becomes a viable strategy for potential buyers. The aftermarket offers a wide selection of luxury watches at competitive prices, allowing for greater accessibility to premium models. This approach requires diligence and a keen understanding of market trends to identify the best deals available.

Adapting to Market Trends: A Buyer's Guide

As the luxury watch market continues to evolve, staying informed about the latest trends and price movements is essential. The current downturn in prices presents a strategic buying opportunity for those looking to expand their collection with high-quality timepieces. With a commitment to posting insightful content, this guide aims to empower readers with the knowledge needed to navigate the market effectively.

Conclusion

The luxury watch market is at a pivotal moment, offering unique opportunities for collectors

(This content was created with the participation of AI, Video from: https://youtu.be/W-j-ix2W4HY)

No comments